IBA, as the premier business brokerage firm in the Pacific Northwest, is firmly established as a respected professional service firm in the legal, accounting, banking, mergers & acquisitions, real estate, and financial planning communities. Periodically, we will post guest blogs from professionals with knowledge to share for the good of owners of privately held companies & family owned businesses. The following blog article has been provided by Brian George. Mr. George, is a wealth advisor specializing in charitable contributions in coordination with business and real estate sales working for www.charitableadvisorsnetwork.com.

Wealth Replacement Trusts – A Wonderful Marriage of Philanthropy and Estate Planning

The Problem(s):

- Individuals hesitate to make substantial gifts to charity out of concern that their family may eventually need those assets after they pass away

- Individuals may be reluctant to sell highly appreciated assets due to capital gains exposure

The Solution:

For individuals with these problems, a “Wealth Replacement Trust” solution may be the answer.

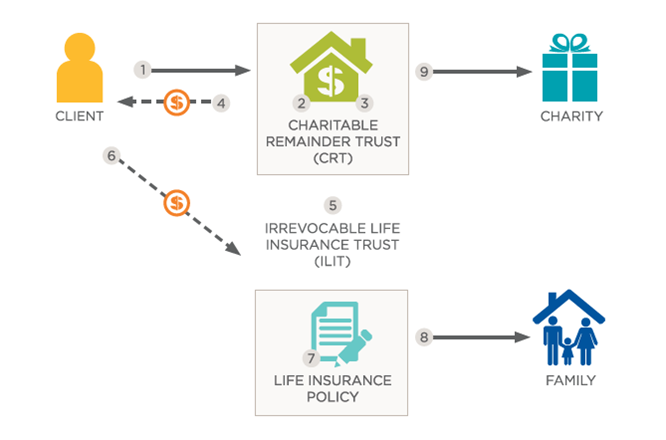

- The wealth replacement trust solution combines three tools:

- A Charitable Remainder Trust (CRT),

- A life insurance policy, and

- An Irrevocable Life Insurance Trust, into a strategy designed to replace the individual’s assets donated to charity in a tax efficient manner.

The Process:

- The donor irrevocably transfers highly appreciated property to a CRT

- The Trustee of the CRT sells the appreciated property and can receive the full fair market value (FMV) of the asset free of income taxes

- The Trustee then uses the proceeds of the sale to invest in an income producing asset

- The Trustee uses the income from the newly invested assets to pay the donor an income stream (a fixed amount or a fixed percentage) for life or for a term of up to 20 years

- The donor also establishes an irrevocable life insurance trust (ILIT) in which the donor has no interest or incidents of ownership

- The ILIT Trustee buys a life insurance policy on the donor’s life (or a second-to-die policy insuring both the donor and spouse) with death benefits equaling or exceeding the value of the property transferred to the CRT

- The donor uses some or all of the income received from the CRT each year to make gifts to the ILIT, which then uses the gifts to pay the life insurance premiums

For the Charity:

At the end of the CRT term, the remaining assets in the CRT are distributed to the designated charity, fulfilling the donor’s philanthropic goal.

For the Family:

At the donor’s death, the Trustee of the ILIT manages and distributes the tax-free death benefit proceeds according to the terms of the trust.

For the Donor:

- Fulfills philanthropic intent to make a substantial charitable contribution

- Receives an immediate charitable deduction for the present value of the remainder interest going to the charity in the year the gift to the CRT is made

- Avoids capital gains taxes on the sale of the appreciated property

- Replaces all or a portion of the assets donated to the CRT with life insurance death benefit to his/her heirs

- Properly structured, the wealth replacement trust strategy removes the appreciated property and life insurance death benefit from the donor’s gross estate

- The donor irrevocably transfers highly appreciated property to a Charitable Remainder Trust (CRT).

- The Trustee of the CRT sells the appreciated property and can receive the full Fair Market Value (FMV) of the asset free of income taxes.

- The Trustee then uses the proceeds of the sale to invest in income producing property.

- The Trustee uses the income from the newly invested assets to pay the donor an income stream (annuity or unitrust amount) for life or for a term of up to 20 years.

- The donor also establishes an Irrevocable Life Insurance Trust (ILIT) in which the donor has no interest or incidents of ownership.

- The donor uses the income received from the CRT each year to make gifts to the ILIT, which then uses the gifts to pay the life insurance premiums.

- The ILIT Trustee buys a life insurance policy on the donor’s life (or a second-to-die policy insuring both the donor and spouse) with death benefits equaling or exceeding the value of the property transferred to the CRT.

- Upon the death of the donor, the ILIT distributes the tax-free death benefit proceeds to the donor’s heirs.

- Upon the death of the donor or the expiration of the term of years, the assets remaining in the CRT is transferred to the charity named in the trust document.

If you have questions relating to Wealth Replacement Trusts, the content of this article, or issues related to Charitable Planning, Brian George would welcome the opportunity to talk with you. Mr. George can be reached at (360) 340-0601 or brian@charitableadvisorsnetwork.com.

Securities & Advisory Services offered through World Equity Group, Inc., Member FINRA/SIPC. World Equity Group and Charitable Advisors Network are independently owned and operated.

World Equity Group does not provide tax or legal advice.

IBA, the Pacific Northwest’s premier business brokerage firm since 1975, is available as an information resource to the media, business brokerage, mergers & acquisitions, and real estate communities on subjects relevant to the purchase & sale of privately held companies and family owned businesses. IBA is recognized as one of the best business brokerage firms in the nation based on its long track record of successfully negotiating “win-win” business sale transactions in environments of full disclosure employing “best practices”.